BrandSensitize | Strategic Brand Evaluation & Marketing Advisory

Recent Posts

Scaling GCCs in the AI-First Era: From Captives to Catalysts of Innovation.

Mars: Building a Purpose-Led Global Brand Through Innovation & Cultural Relevance

follow us

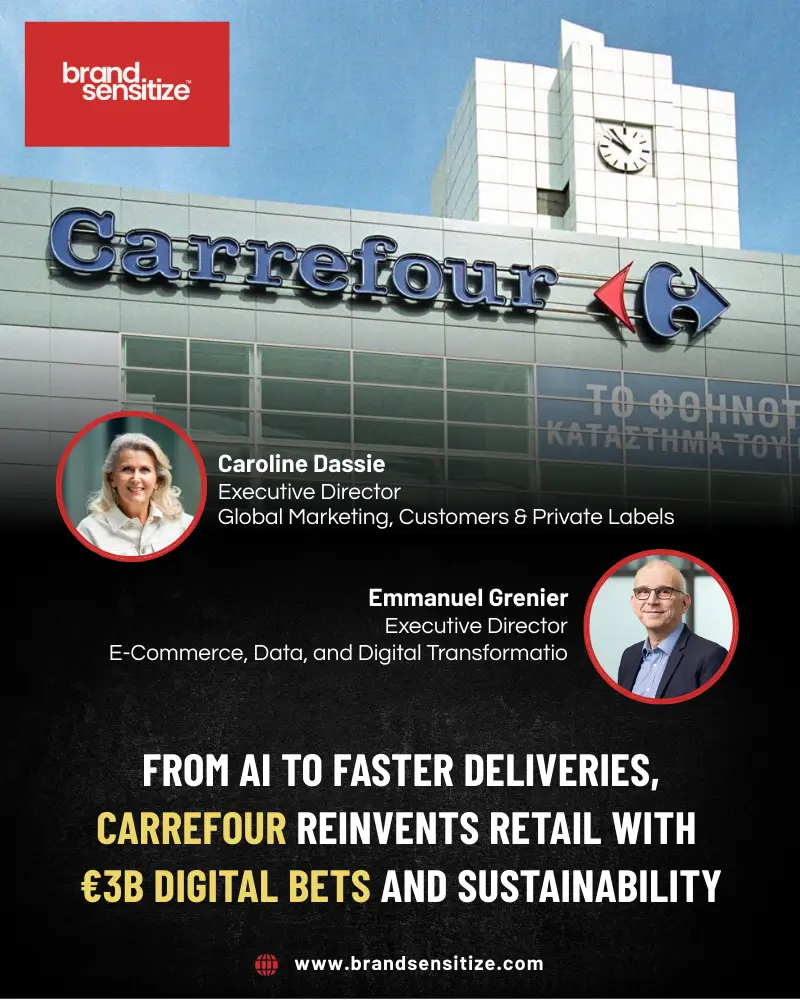

Carrefour's Digital Leap: How AI and Quick Commerce Are Redefining Retail by 2026

Alexandre Bompard, Chairman and CEO of Carrefour since 2017, delivers a leadership message centered on radical transformation to position Carrefour as a customer-focused, digital retail company that leads the “food transition for all,” highlighting sustainable growth, affordability, and innovation for long-term value creation.

In a retail landscape dominated by giants like Amazon and Walmart, Carrefour is quietly reshaping the industry with its 2026 Digital Retail Strategy, tripling e-commerce GMV to €10 billion while investing €3 billion in AI and omnichannel innovation. Here’s how this French powerhouse is merging food-first values with cutting-edge technology to stay ahead.

What if the future of grocery retail isn’t just about speed or scale, but about making ‘better food for all’ accessible at unbeatable prices?

As consumer shopping habits and e-commerce continue to expand, Carrefour distinguishes itself with a strong private-label segment (accounting for 40% of food sales) and innovative quick delivery services, like 15-minute deliveries via Uber Eats. This isn’t just adaptation; it’s a unique strategy that sets it apart from discounters such as Aldi or Lidl.

From pioneering hypermarkets in the 1960s to leading the food transition today, Carrefour’s journey is a masterclass in evolution. With €87 billion in 2024 revenue and a bold plan to integrate generative AI for smarter supply chains, they’re proving that heritage brands can thrive in the digital age.

Carrefour reported total revenue of approximately €87.3 billion for the full year 2024, according to its FY 2024 results disclosure.

Carrefour adopts pricing architecture and sourcing to keep staples affordable while improving quality and transparency (e.g., Carrefour Quality Lines).

A strong push to increase own brands to 40% of food sales by 2026 enables better control over quality, innovation, and pricing structures across entry, premium, and trend segments.

An integrated network of stores, marketplaces, and fast delivery options enhances accessibility and shopping frequency, strengthening Carrefour’s position as a daily food destination while maintaining its brand equity, which is rooted in value and responsibility.

Carrefour’s €10 billion e-commerce goal isn’t just about numbers; it’s a plan for sustainable, value-driven growth.

Like many others, Carrefour is also transitioning from a traditional retailer with e-commerce capabilities to a Digital Retail Company. Carrefour’s customer connect strategy is founded on a “data-centric, digital first” approach and is being carried out based on four key drivers.

- Acceleration of e-commerce

- Ramp-up of Data & Retail Media activities

- Digitization of financial services

- Transformation, through digital, of traditional retail operations

Carrefour is accelerating e-commerce by expanding multi-format fulfillment options, including drive, home delivery, and express services, to triple GMV (Gross Merchandise Value) to €10 billion by 2026. The company is also heavily investing in quick commerce with express delivery in under 3 hours and ultrafast drops in under 15 minutes, supported by partnerships like Uber Eats, Cajoo, and Bringo, as well as pilots such as OK Market! Personal-shopper services in France.

Carrefour is investing €3 billion in digital initiatives by 2026 to enhance data, e-commerce, and omnichannel strategies, driving faster delivery, larger marketplaces, and new revenue streams, such as retail media and fintech.

Carrefour improves the shopping experience with instant review systems, personalized offers, multichannel support, and simple return options.

Carrefour’s AI strategy integrates AI into customer experience, operations, and media to support a data-driven, omnichannel retail model under its 2026 plan, utilizing generative AI, predictive analytics, and computer vision at scale.

With apps like Scan & Go, outlet tracking, and Fix & Repair, Carrefour guarantees speed, simplicity, and a smooth workflow.

The company also uses AI to improve both the shopping experience and operations through systems like AI Carrefour and Hopla, which support staff and provide personalized buying suggestions.

In outlets, innovative racks, vision sensors, and bots improve inventory accuracy and workflow, while cloud insights enable real-time adjustments.

Across supply networks and retail media, AI enables automation and targeted engagement, making Carrefour’s store model more seamless and intelligent.

It collaborates with global technology, supply, and marketing partners to improve its operations and customer offerings.

The retail giant is opening new stores in Spain, Israel, and Kenya, and plans to expand in India.

The group continues to strengthen its market position while adjusting to regional shopper needs.

Retail media and connected store solutions enhance personalization and achieve better marketing results.

What makes Carrefour unique is its large worldwide network, variety of store types, and focus on innovation.

The group leverages AI, innovative racks, and digital platforms to enhance both shopper and staff experiences.

Carrefour’s main technology partners are engaged in various initiatives, such as cloud, AI, data, retail media, e-commerce logistics, and product development platforms, which support its data-driven, omnichannel strategy through 2026.

Google Cloud supports Carrefour’s data platform modernization and cloud migration, enabling analytics and AI use cases at scale across different countries and formats.

Artefact partners with Carrefour on data and AI industrialization, retail media measurement, and sustainability analytics within broader data initiatives.

OpenAI technologies power generative AI features such as shopping assistants and content automation on Carrefour’s digital platforms.

Carrefour has also highlighted internal AI facilities and partnerships that use AI for pricing, assortment, and supply chain optimization alongside cloud providers and data specialists.

Publicis Groupe formed a joint venture with Carrefour to grow retail media in Europe and Latin America.

Publicis Sapient has partnered with Carrefour to develop unified e-commerce platforms and customer-focused digital transformation, aiming to accelerate feature delivery and boost conversion rates.

Centric Software provides PLM for private-label and multi-category product development, supporting quick time-to-market and cost savings aligned with the 2026 plan.

BrandSensitize™ research shows evidence of major IT services and consulting firms collaborating with Carrefour, especially Capgemini and Publicis Sapient, along with strategic and technology partnerships involving Bain & Company with Microsoft/OpenAI.

Comments

Keith Nicks is EVP and Chief Digital & Commercial Officer for Ahold Delhaize USA, overseeing

omnichannel marketing, retail media, and e-commerce for U.S. brands. Tim Bork is the Chief Commercial

Officer for Ahold Delhaize Europe & Indonesia, focusing on local brands and responsible for growth,

including marketing and customer experience.

With nearly €96 billion in projected 2025 revenue, Ahold Delhaize ranks among the top 10 global

retailers, operating over 6,700 stores across multiple formats, including Albert Heijn, Delhaize, Food Lion,

Giant, Hannaford, and Stop & Shop.

6,700 stores powered by one procurement platform – a scale that makes others jealous.

For customers, Ahold isn’t just a grocery retailer; it’s a trusted lifestyle partner that combines the

intimacy of local shopping with the innovation and value of global retail leadership.

Ahold’s brands, such as Albert Heijn, Stop & Shop, and Giant, represent 37 years of average customer

relationships—customers don’t just shop there; they grow up with these brands, creating emotional

connections that transcend transactions.

After gaining thirty million loyalty members, Ahold demonstrated that personalization consistently

outperforms promotion.

BrandSensitize™ research shows that Ahold Delhaize operates with a decentralized marketing and brand

building approach, where marketing functions are embedded within:

- Brand-specific leadership (each local brand has its own marketing teams.

- Regional commercial officers who oversee marketing alongside broader commercial

responsibilities. - Digital and omnichannel specialists who handle modern marketing channels.

Ahold Delhaize’s Brand Building Initiatives:

Sustainability campaign: €50M investment reached 10M consumers, delivering a 20% boost in

sustainable product sales and generating €400M in revenue.

Digital Marketing: €150M digital budget achieved 25% higher engagement, 2.6% click-through rates (vs

1.9% industry standard), and built 500K+ social media following.

Loyalty Program: 30M members across brands with 85% customer penetration, driving 75% of total sales

and contributing €1B annually—10% better retention than competitors.

Strategic Brand Partnerships: 100+ collaborative campaigns with CPG brands, including Coca-Cola,

generated €600M in additional revenue through joint promotions.

Omnichannel Investment: A $1 billion price investment initiative, combined with AI-powered

personalization, aims to achieve an 80% loyalty sales penetration by 2028.

Strategic marketing drives measurable business results—from sustainability messaging to digital-first

loyalty programs, Ahold Delhaize demonstrates that well-executed brand-building campaigns deliver

both customer engagement and bottom-line growth on a global scale.

Ahold Delhaize’s Strategic Technology Partnerships:

- W23 Global VC Fund: $125M investment with Tesco, Woolworths & others backing AI startups

like Harmonya & Protex AI - Zycus Partnership: Source-to-Pay suite powering procurement across 6,700+ stores globally

- Hanshow Technology: Electronic shelf labels + innovation labs across all European locations.

- Inmar Intelligence: $141M in customer savings delivered through personalized digital coupons.

- DoorDash Collaboration: Tripled order volumes through enhanced last-mile delivery integration.

- Internal AI Innovation: MaxiGPT, LionGPT & Albot assistants deployed across the Serbian,

Belgian, and Czech markets. - New Tech Studio: AD/01 in Bucharest targeting 250+ tech talents for digital acceleration.

Zycus has licensed its comprehensive Source-to-Pay suite to Ahold Delhaize, including eSourcing,

Contract Lifecycle Management (CLM), and Supplier Management platforms.

TCS’s relationship with Ahold Delhaize marks a mature, strategic partnership focused on digital

transformation and supply chain technology.

Wipro partnered with Capgemini as one of the most significant retail transformation initiatives in the

world at Ahold USA.

Capgemini powers Ahold Delhaize’s end-to-end transformation, developing blockchain technology use

cases for Ahold Delhaize’s supply chain and leveraging its expertise in business transformation, as well as

its understanding of Ahold’s industry and operations.

Traditional retailers, equipped with AI and Robotics, will surpass pure digital players by 2030.

The key is to position Ahold not as just another retail success story, but as the company that has

rewritten the rules of digital transformation for every traditional business watching.

Leave a Reply